-

In the HR Manager Portal, open the employment record for the team member.

-

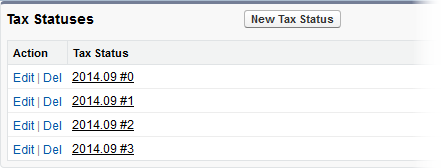

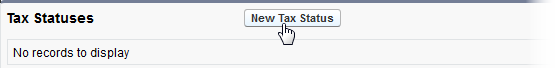

Scroll down to the Tax Statuses related list and select New Tax Status:

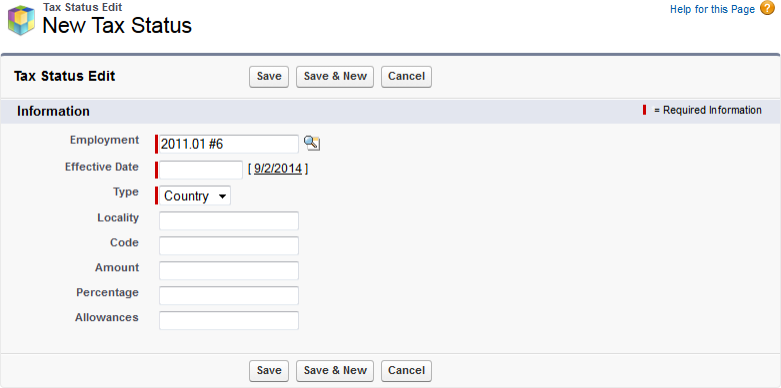

Sage People displays the Tax Edit page:

-

Complete the fields as follows:

Field Description Employment The employment record you selected at the start of this procedure. Sage People automatically completes this field for you.

To change employment record, select Employment lookup

, find and select the record you want.

, find and select the record you want.Effective Date The date you want this tax status to start. Can be a past date, today, or a future date.

Select the field to display a calendar and select the date you want, or select today's date to the right of the field to select today.

Type Picklist. Select the picklist and select the type of tax to which this record applies:

-

Country

For example Federal or national tax.

-

Region

For example State tax.

-

City

Locality Text. Optional. Enter the name of the country, region, or city imposing the tax, or some other identifier that clearly identifies the tax. Code Text. Optional. Enter the code associated with the tax. Amount Currency amount. Optional. Enter an amount if the tax is charged at a fixed value for each period. You can alternatively enter a value in Percentage. Percentage Percentage rate, up to two decimal places. Optional. Enter a percentage if the tax is charged at a fixed rate. You can alternatively enter a value in Amount. Allowances The value of any allowances the team member can deduct from the tax. -

-

Select:

-

Save, to save the tax status record and display the Tax Status Detail page.

-

Save & New to save the tax status record and display a new Tax Status Edit page for you to enter another record.

-

Cancel to discard your changes and display the employment record.

-

Completed Tax Status records are added to the Tax Statuses related list on the team member's employment record: