Some benefit changes do not fit cleanly into either New Enrollment or Life Event cases. For example:

-

Adding a new dependent without a plan change (such as adding another child to a family plan)

-

Increasing life insurance coverage from Approved to Additional Amount

-

Mid-year Flexible Spending Account (FSA) changes.

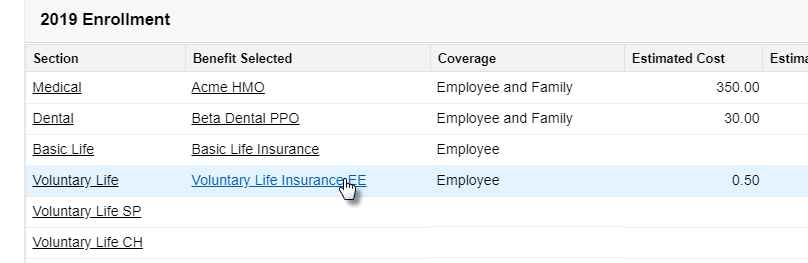

Adding a dependent without change in cover

If an employee has family-level coverage for benefits and adds another child dependent, many organizations will not treat this as a qualified life event that enables the employee to change benefits with preferential tax treatment. If you treat adding additional dependents as a qualified life event, follow the steps outlined for Mid-year life events. If you do not treat it as a qualified life event, add the new dependent to the existing benefit selection in the Benefits Related List.

When the Team Member has added the new dependent in WX (or the HR manager has added the dependent on the related list under team member), you can add the dependent to the benefits under which they will be covered.

To add a dependent without a change of coverage:

-

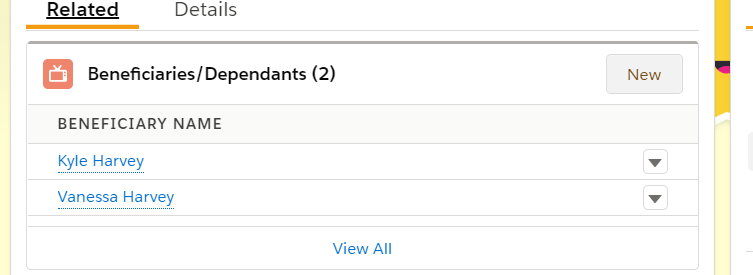

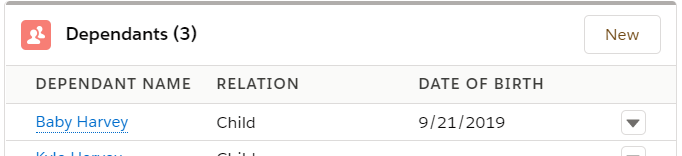

Ensure the new dependent has been added by checking the Dependents related list for the team member. Add a dependent if required by selecting New.

-

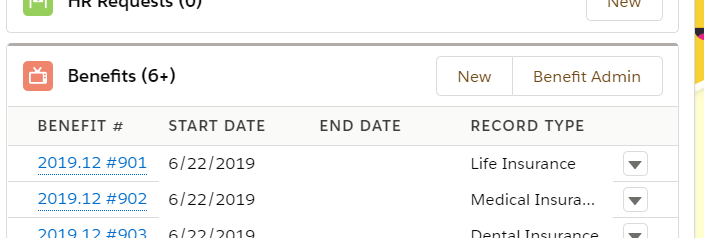

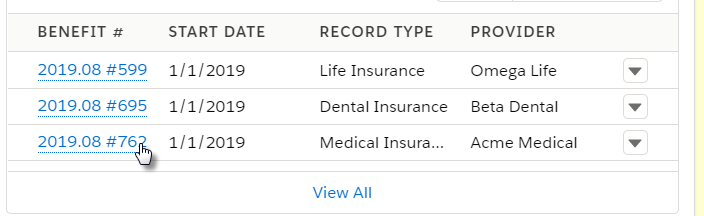

In the team member's current employment record, select the appropriate benefit from the Benefits related list:

-

Select New.

-

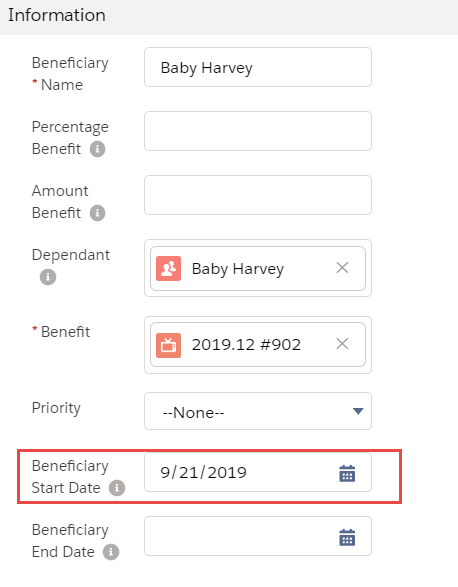

Enter the beneficiary's full name in the Beneficiary Name field.

-

Search and select the Dependent Record.

-

Enter the Beneficiary Start Date as the first day this new dependent is covered by the benefit. Typically the date of birth for a new dependent.

NoteThis step cannot be performed by the team member in WX. If the employee adds the dependent as part of the enrollment process, the dependent's coverage start date is backdated to the employee’s enrollment date.

-

Select Save.

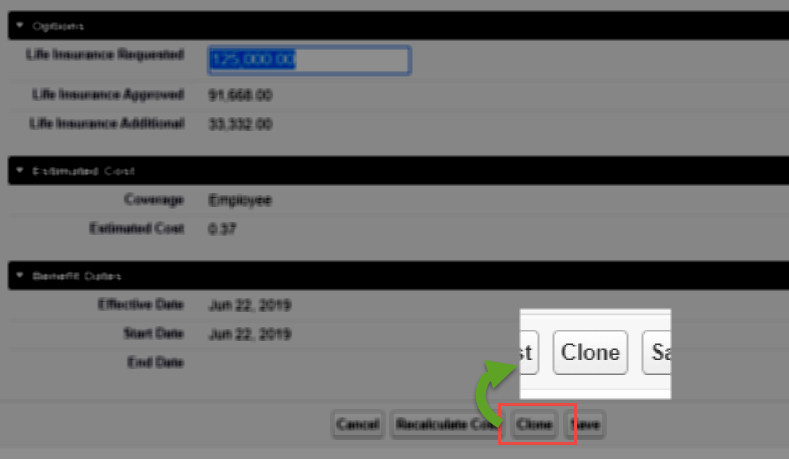

Increasing life insurance coverage to EOI amount

If an employee has requested life insurance coverage greater than the guaranteed amount, Sage People will have two amounts on the record:

-

The approved Life Coverage amount.

-

An additional Life Coverage Amount.

When the carrier makes a coverage determination you will need to update the Life Insurance record with the approved coverage by following the steps below:

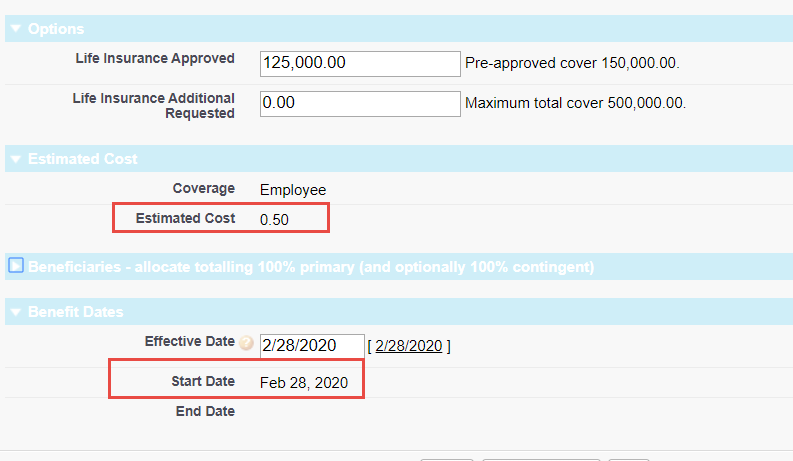

-

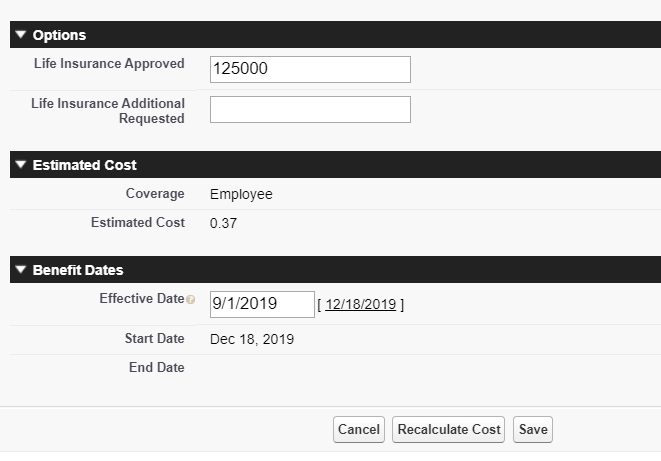

Enter the new Life Insurance Approved amount and clear the Life Insurance Additional amount field. Enter the Effective Date for the new approved amount.

Note

NoteThe start date will update when you select Save or Recalculate Cost.

-

Select Recalculate to see the new start date and cost.

-

Select Save

Mid-year FSA changes

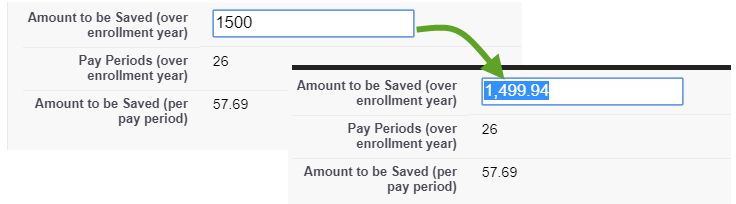

If an employee wants to change the amount they save for a Flexible Spending Account (FSA), note that Sage People does not take into account year-to-date payments. For example:

An employee initially elects to contribute 1500 (calculated as 57.68 per pay period, resulting a recalculated total of 1499.94).

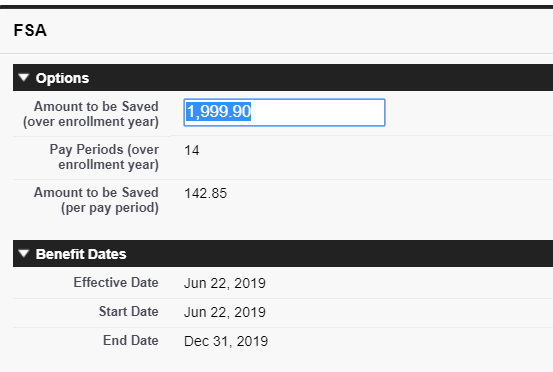

Part way through the year, the employee has a life event and wants to change the amount they contribute. The new annual amount they want to save will be calculated per pay period, based on 14 remaining pay periods:

However, based on the previous election of 57.69 per pay period, the employee has already contributed 692.28 (57.69 multiplied by 12 pay periods).

To calculate the new amount to save for the remainder of the year, subtract the contributed amount from the new requested amount.

In this example:

2000 – 692.28 = 1307.72. (Recalculated to 1307.60)